Truck Trailer Price raise up, Logistic Company how to do?

Truck semi trailer for logistic company knowledge

This article is a little long, please be patience, you need some minutes to finish all. But after you finished, you will feel it worth Millions Dollars to you. And help you saving more lost, and earn more money in near future.

First of all, please allow us to write the most important conclusion in front of this article.

1, Rising raw materials price is fair to everyone, so as the Ocean Shipping cost. You should know: not just you need pay more money to buy trailers now, but also your competitor logistics companies too.

2, Before the end of the Covid-19, there will be no chance that truck trailer price going down.

3, After the Covid-19 is over, it will still be bad for a long time.

4, A wave of great logistics opportunities is coming, and logistics partners must seize the opportunity! If you don’t, your competitor will do.

5, it is not purchase trailers to help them win profit, but it is using the trailers doing transport business, to help them win profit. The more early they purchase trailers, the more early they can using the trailers to earn more money.

6, We suggestion you: if you don’t have enough money in hand, then you can try less order quantity first. For example, if you only have 5 units trailer money, then please just start 5 units first, don’t waiting to 10 units trailer order now. Otherwise, even in 2022, you still not have money for 10 units trailer order. Even your old plan is buy 10 units trailer in one time.

“In fact, about steel raw material prices increase was discussed with you in last November 2020. The increase in raw material prices is an inevitable result this year. Why do we say that?

There are actually two reasons for this.

1, the scarcity and reduced production capacity caused by the Covid-19.

2, and on the other hand, it is because of the consequences of depreciation of the US dollar.

In many raw materials, it needs to be change by U.S. dollars in the international market. The depreciation of U.S. dollars has indirectly affected the raw materials price raise up.

Including oil and a large number of futures goods, only allowed to trade by U.S. dollars in the world (you know this situation in the world?), so the depreciation of the U.S. dollar means that these things will increase price directly.

Did you notice your local oil price is raising up than before, if you have a car need add oil? And also other products, specially connect with Steel, Iron, Oil, copper, plastic, those products price is raise up too?

Therefore, in Q1 this year, the United States desperately printed USD Dollars, and the same operation was performed. The USA Fed (the Federal Reserve) started the money printing machine, and began desperately lending money, and it is about to enter the highest position in the range again.

This time, it will last much longer…

USA Let the whole world work in exchange for their green paper (USD dollars).

Simply saying is: USA has a poor economy since Covid-19, so they print more papers (USD Dollars) to buy products from the whole world, to saving their poor economy.

The United States is not getting out of the predicament in short time. They still need global support, and will continue to harvest for a year or a half; this move will directly lead to a rise in the raw materials prices around the world.

This is why I always said that: business man must be aware of the overall situation and take good care of risks.

Of course, the above is only one reason for the raw material prices raise up.

The deeper reasons are definitely not the only one above. In today’s situation, many people not only pay attention to the reasons behind the products prices raise up, but also want to know what the solution is.

How should the logistics business go in the future? How should the logistics pattern change in the long run? Are there any huge business opportunities hidden in this?

At the same time, for this sudden crisis, what we need to do in logistics business area?

Too many people are full of anxiety about the logistics industry (specially about buy new truck trailers is right time or not), and cannot find a direction. Normally, the change in the outside world will affect your mentality.

Especially when you see that when you are deeply affected by trailer price raise up day by day, there are still many logistics companies still got more and more logistics orders, and buy more and more truck trailers to expand their local logistics business orders. 95% of our new trailers are ocean shipping to Africa logistics companies.

For example:

· A Africa friend in the negotiation stage, the customer even not cut price, but confirm 12 month transport business order.

· A Africa friend has reached an annual profit of 0.5 million in the second year of starting a business;

· After a friend recommended a new transport company to a customer, he directly won an order of 130,000 USD orders.

……

You can see a lot of logistic company doing business like this, and many people wonder how they did it.

And after reading the review of these friends, I found that they all have a careful mind and a negotiating mindset that is not afraid of danger.

Not to mention that I can give you the most correct solution, but at least my experience and ability can help you avoid troubles.

Like those friends, I can still have confidence in this year’s logistic business.

The collision between thoughts will still not let you down.

Below is the questions which the logistic company face, when buy truck trailer this year.

Raw Material Price

The big problem is the current rise in raw materials. What everyone thinks is that the prices of raw materials have risen all the way. If they rise again, the truck trailer price will raise up again, what should you do?

So these are the three issues that cause logistics company buyers common anxiety:

1, exchange rate.

2, ocean freight.

3, and raw material issues.

Then let’s think about what our current situation, after encountering these three problems.

The first questions are clear to everyone (people cannot control, only the government), so let’s talk about the 2nd & 3rd question specifically, which is also our theme this time: rising Ocean shipping price & raising raw materials.

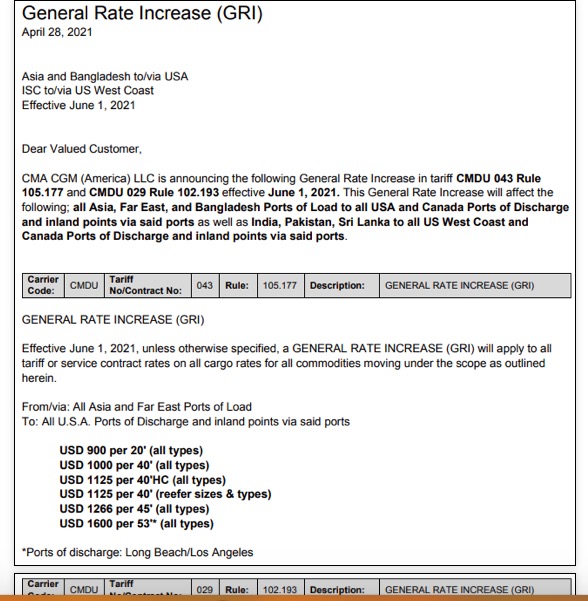

Now I am looking for 3 pictures for everyone to see (the picture below):

Ocean shipping price. As you can see: the different Shipping Lines have making notice, the Shipping cost will raise up to 1,200USD per 40ft container in some shipping line. Others cannot control, and we must follow their price, because the whole world is same situation. We believe you don’t have ability to doing transport truck trailers by airplane, right? (okay, it’s a joke).

The Oil Price won’t drop and raise up, it will be making the Shipping Price raise up again and again. In some ports, one container is already raised up to 12,000 USD, and even you paid the money, you’re still not able to get the container confirm, because they are lack of containers now.

If you always keep notice the information we send to you before, then you should know: the Ocean shipping price was 1,650USD per 40HQ container to East Africa in 2020. But now, it is 6,000USD already.

To Hamburg, Germany, it is already raised up to 11,500USD per container (2020 was about 1,800USD).

If in America (you know the Covid-19 situation in America), each container already raise up to 15,000USD or more, and you still cannot 100% sure to get the container booking, because they are lack of containers now.

The best time doing the ocean shipping is: the moment when you already have cash in hand, and the best time is today, not tomorrow.

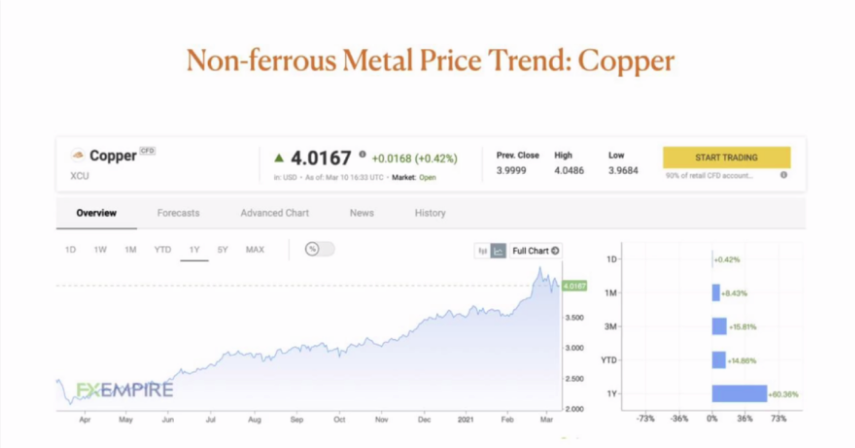

—Rising trend chart of non-ferrous metal (copper, steel is same) raw materials—

Assuming that the products you make are related to non-ferrous metals, such as power supply support boards, power cords, etc., such products use a lot of copper; The truck trailer is using lots of Steels.

That is to say, in the international market, if the price of copper raw materials rises sharply, it means that the products you sell or buy, the price will surely rise, and the import FOB price must go up.

This is the current price trend related to non-ferrous metals. Not only copper, but a series of other related metals, most of them are going up. And the increase is very obvious.

So it means: the truck trailer you need to buy, the price will continue to raise up.

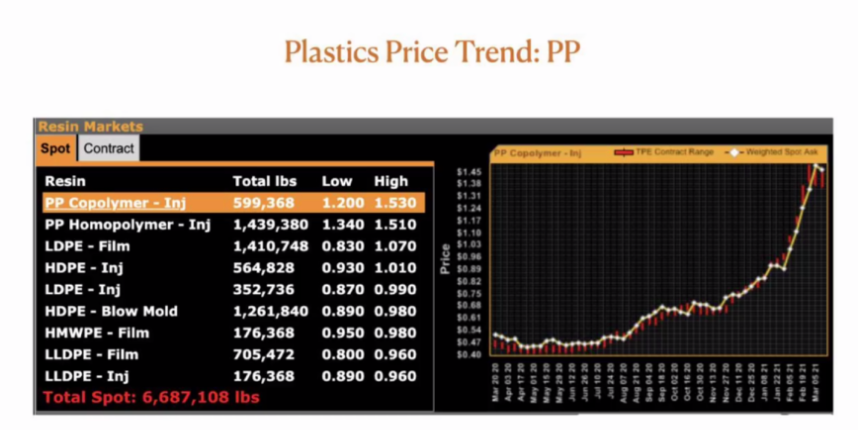

—Plastic product raw materials rising trend chart—

Let’s look at another material: plastic.

Whether it is PP or ABS, etc., all prices are basically going up. Regarding the material of PP, you will find that the trend chart on the right is also going up.

So you can tell just by looking at this trend, no matter the plastic products, or the metal products price are all going up. Therefore, all products, which connect with these raw materials are raise up, based on last year’s data.

What caused it? Is it a short-term situation or an imbalance between supply and demand?

I can tell you, this situation (truck trailer price) is very difficult to reverse in the short term. This is a very realistic situation.

When you face this type of problem, you must have a image in your mind, there will be no big fall back in the short term.

When will there be a turn around?

Let’s see a news first:

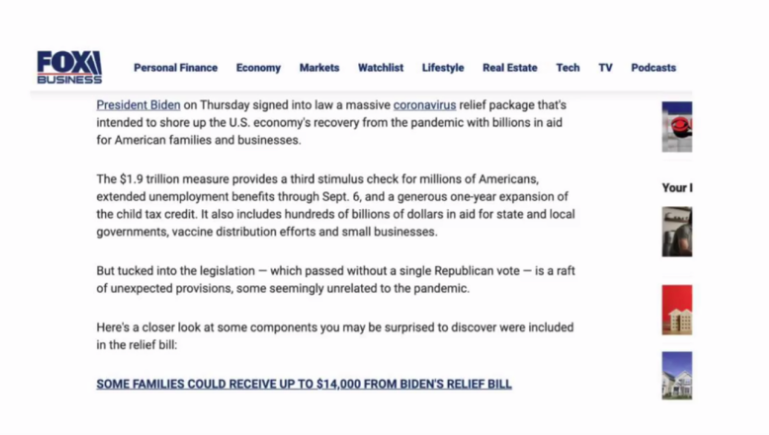

This is a screenshot I randomly downloaded from FOX News. It mainly refers to the $1.9 trillion in relief, that the current US President Biden has applied for.

What problem can this say?

Under the covid-19, the U.S. economy is not good, and the unemployment rate has increased. Therefore, the President of the United States requires Congress to pass a decree to allocate $1.9 trillion in relief.

What is this concept?

In other words, it is tantamount to telling everyone, that Congress has passed it, the United States is going to start the money printing machine (print 1.9 trillion USD dollars to the market), and the Fed is going to start lending.

So as soon as this news comes out, I can tell you a very positive conclusion that:

all raw materials will fall sharply for a long period of time does NOT EXIST,

and the possibility of a sharp price correction does NOT EXIST.

As you can imagine, most of the non-ferrous metals we talked about are in a balanced state. There will be growth and decline, but they are basically in a relatively balanced state.

If many factories are shut down, what will be the result?

As a result, there may be a surplus of non-ferrous metal raw materials, such as copper, in the market. After the surplus, the price will fall, and the price will fall, and the producer will reduce the output, and then the price will reach a more balanced state.

What is the PP plastic mentioned above?

Plastic is a product extracted from petroleum. If the price of petroleum rises sharply, plastic particle products will be very expensive.

The current situation is that the United States is lending money, and the United States is printing money, which means that all inflationary factors will be paid for by the whole world (America government is a b’tch, right?).

Maybe you still don’t understand, how big this 1.9 trillion U.S. dollar is. Then you can compare your countries export volume in one year, and you will know how terrible this is.

So many currencies rush to the market, which means that the price of all assets calculated in dollars is raising up.

That is 100% sure to telling everyone, that in a short period of time in the future, you should not expect the raw materials price to fall sharply at all. So as you buy Truck Trailer price not fall too.

But it is also possible, For example, tomorrow, there may be a situation or reason that many Chinese factories start to shut down. If Chinese factories start to shut down, and reduce supply, and plus the current shortage of existing Africa, European and American countries. Under the circumstance, the overall production demand in the market decreases, and the price will fall when the demand decreases.

But the rate of decline must be higher than the rate of money lending and printing money in the United States. You must beat the rate of the Federal Reserve before the price can go down. But in fact, everyone knows that this possibility is extremely low.

So in the current situation, which question should we look at? I have written two conclusions here:

Conclusion 1: Before the end of the Covid-19, there will be no chance that truck trailer price going down.

Because of the USA money lending & money printing, it will lead to an overall increase in the global price of oil, bulk commodities, international trade, and logistics and transportation denominated in US dollars.

After the US dollar is heavily invested in money, goods will become more and more expensive after the imbalance between supply and demand.

This is the same as printing money. Under such circumstances, the probability of a sharp drop in the price of different raw materials is very low.

Even if the Chinese (other countries) are constantly exporting, because all the raw materials you purchase, whether it is oil, or non-ferrous metals, are all trade in U.S. dollars on the international market. You have to buy them with U.S. dollars. But USA printing money & lending money, the U.S. dollar is not as valuable as it used to be, and it is impossible to maintain a strong position of U.S. dollar. What should we do at this time?

You have to use the standard currency to exchange the existing U.S. dollars. One reality that everyone can see is: the impact of exchange rates and the impact of raw materials.

Conclusion 2: After the Covid-19 is over, it will still be bad for a long time.

Because after the Covid-19 is controlled, manufacturing capacity in Europe, America and the world will recover. At this time, the shortage of raw materials will intensify, and the supply and demand relationship will continue to be unbalanced.

In the case of the Covid-19 last year, the global manufacturing industry relied on China, so the Chinese are desperately exporting to help the world reduce the burden. All the commodities you need for food, clothing, housing, and transportation are China’s responsibility.

After the Covid-19 in European and American countries, a large number of factories are under-operated, and foreign trade is in a mess. All consumer products are dependent on China’s imports. However, if the Covid-19 is controlled, the production capacity of factories in UK, France, Germany, Africa, and the United States will recover, and the Japanese factories will be fully integrated. When it starts, their demand for raw materials will increase at this time.

Now it is in a shutdown state or a half-start state, the production output may be insufficient, and the required raw materials may also be insufficient.

But when they fully recover, they will need more raw materials. At this time, the relationship between supply and demand will be unbalanced again.

At that time, everyone think about it. The United States has printed so much money, and the raw materials are very expensive. When Western countries in Europe, and the United States begin to recover the manufacturing industry, just like the Chinese manufacturing industry, when everyone needs raw materials, raw materials are even more scarce, cost will raise up again.

So, regardless of whether it is during the epidemic or after the epidemic is over, I think it is difficult to alleviate this situation of rising raw materials in the short term. There may be fluctuations, but the overall trend is still going up.

As for how much it will rise, it depends on how quickly the Americans print money and lend money. To put it easily, whether America is more shameless, or even more shameless, this determines the price of international raw materials.

What happened next when we encountered such a situation?

The conclusions just mentioned are all bad. The exchange rate is not good, and the ocean freight will not fall sharply in the short term. It may slowly go down. Plus with the pre-Covid-19 + after-Covid-19 raw material situation, the current situation is It is also not optimistic.

In the future, the European and American manufacturing industries will recover, and the relationship between supply and demand will become even more imbalanced. With so many pessimistic states, will the next situation be more pessimistic?

*The market is shrinking again.

*New growth points are hard to find.

*Price negotiation is very difficult.

*Customers began to wait and see further.

In addition, under the Covid-19 situation, customer sales are not so strong. It may only return to about 10%. There is no need for so many goods. The goods in the existing warehouse can last for half a year. Customers could have stocked up or they could. Wait a little longer, then when your price goes up at this time, he will feel he is better still waiting.

Because the current situation is not clear.

*Many logistics friends will be very worried about the above four problems.

Isn’t the real situation like this?

I think there may be part of the reason, but my point of view is completely opposite!

I think all is wrong.

Instead, I think that a wave of great opportunities is coming, and logistics partners must seize the opportunity!

Why do you say that?

This is not deliberately blogging people’s eyeballs, making headlines. I have my reasons for saying this,

My reasons are:

At the time of the financial crisis in 2008, many small partners may not have started to do logistics at that time. I joined the industry in 2005 at that time, and it was almost two to three years before 2008.

What kind of situation was clearly felt at that time?

I think it is a big benefit for our company, when I was still a small salesman.

The economic crisis came, when the Chinese Currency Renminbi raise up, and these factors combined, at that time there was a huge increase in inquiries, and customers who were unable to push them started to respond and interact again.

And these clients placed order more than ever before at last.

Now, the situation is so similar as 2008, over US$ 100 million Semi Trailers and Pulling Trailer sales worth of trailer sales, only in 5 months of 2021.

Why this happens? Are these logistic companies going crazy? Because the trailer price is raising up again and again in 2021.

No, these logistic companies not crazy at all. In the opposite, they are very clever!

Because these clients (logistic companies) know:

1, because of Covid-19, many businesses is slow, many products price is raise up. But all people need using different products, all their country (include their close countries) must need to transport their products.

Most importantly, things are:

A, they try best to get more orders, and buy more truck trailers to support their transport business. Otherwise, they don’t have extra ability to accept other clients transport orders.

B, because they always stay in communication with us, so they know the trailer price is raising up, the Ocean shipping price is raising up very more than 2020. So the Total CIF Price is 100% need to raise up in 2021, and even in 2022.

C, they know: it is not purchase trailers to help them win profit, but it is using the trailers doing transport business, to help them win profit. The more early they purchase trailers, the more early they can be using the trailers to earn more money. Not like other logistics companies don’t know the situation, just want waiting for the cheapest price, more delay, more expensive trailer will be.

D, they know other local logistics companies just want to save cost, don’t know most important thing is: get more transport orders, to earn more profit.

E, they know, because of Covid-19, lots of goods price is raise up, so the Transport quotation price will be raised up too (compare to before Covid-19), they can earn more profit than ever before.

F, some of them don’t have enough money to purchase big quantities’ trailer, so they try to deduct order quantity, so they can pay all of these orders (for example, client plan to buy 100 units trailer, but because price raise up, don’t have enough cash now, so change to order 90units trailer to instead first, after win more profit, then purchase more trailers again). Try as fast as they can, to earn more transport orders after got new trailers from DTG Group Trailer.

After you read these 6 information, sincerely wishing you understand the important thing now?

So, what DTG Group Trailer can do for your logistic business in these situations?

Here we promise:

1, we don’t raise up price, if the Raw materials price raise up less than 5%.

2, we don’t raise up price, if the Ocean shipping price raise up less than 5%.

3, if the Raw materials price raise up more than 5%. We will bear with you together. So as the Ocean shipping price too.

4, we don’t use lower quality to reduce the Trailer cost. Also, DTG Group trailer never win the trailer orders by lower price, it’s not what we do.

5, we suggestion you: if you don’t have enough money in hand, then you can try less order quantity first, for example, if you only have 5 units trailer money, then please just start 5 units first, don’t wait to 10 units trailer order now. Otherwise, even in 2022, you still not have money for 10 units trailer order.

We will prove you: our trailer & service are fully worth it.

★Summary:

* Raw materials price raise up is fair to everyone, so as the Ocean Shipping cost. You should know: not just you need pay more money to buy trailers now, but also your competitor logistics companies too.

*you do business with customers, not with trends.

*Not everyone is suitable to follow the trend.

*Let customers feel that you are a reliable logistic company, trust is enough, then you can win your customers logistic orders.

*What we are afraid of is not the rise of raw materials (so as ocean shipping cost raise up), but the fluctuation of customer psychology. This is the real thing you need to worry about.

About DTG Group Semi Trailer.